What is Cash Compass?

Your go-to for managing your cash.

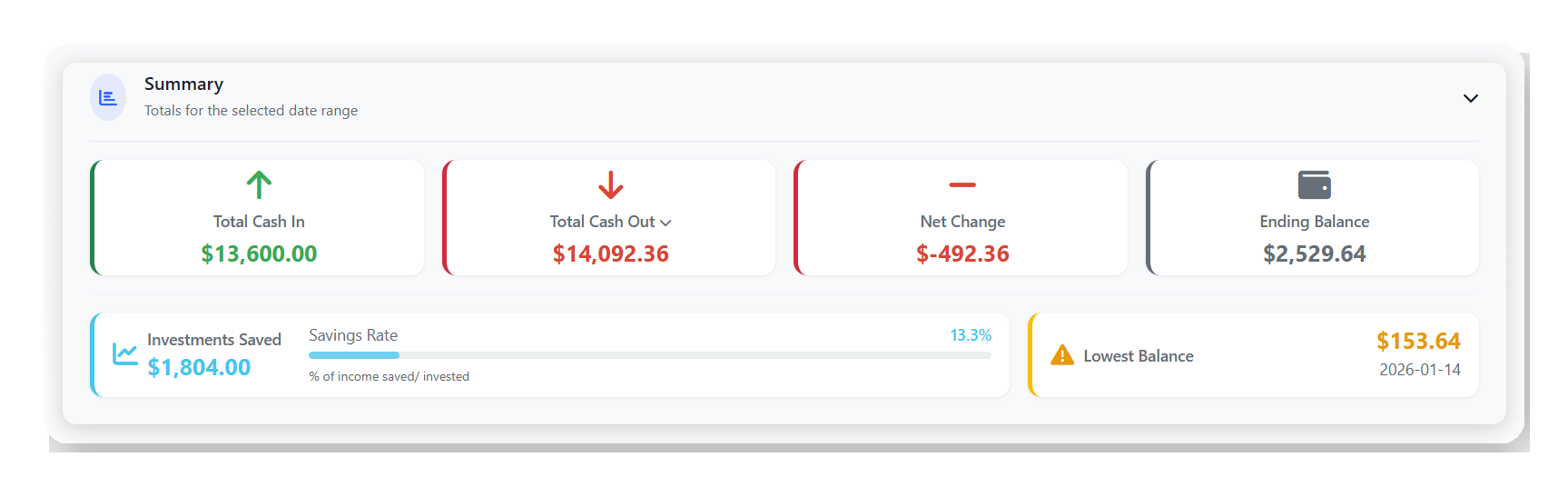

Cash Compass shows you exactly how much you can spend, save, and invest by projecting your cash flow across any timeframe you choose to analyze. It helps you always know where your balance will land while staying on track with your financial goals.

If any of these sound familiar, Cash Compass is for you

You're not sure if you can actually afford something until the month ends.

Your credit card bill surprises you.

Saving and investing feels random instead of intentional.

How Cash Compass helps you stay ahead of your money

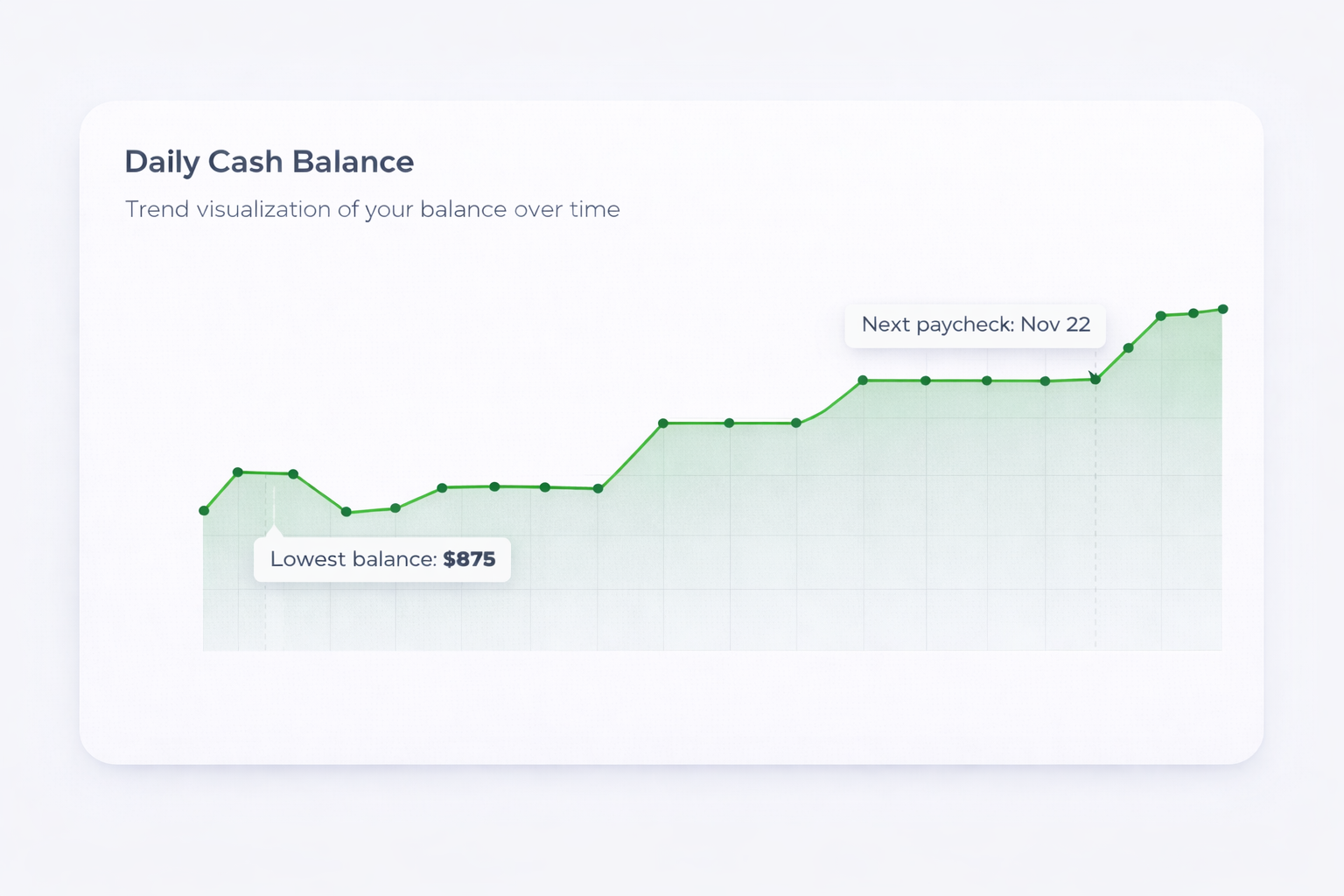

Forecast your cash flow like a business

See your projected balance days or weeks ahead. Understand exactly when money comes in and goes out so you're never caught off guard by upcoming expenses.

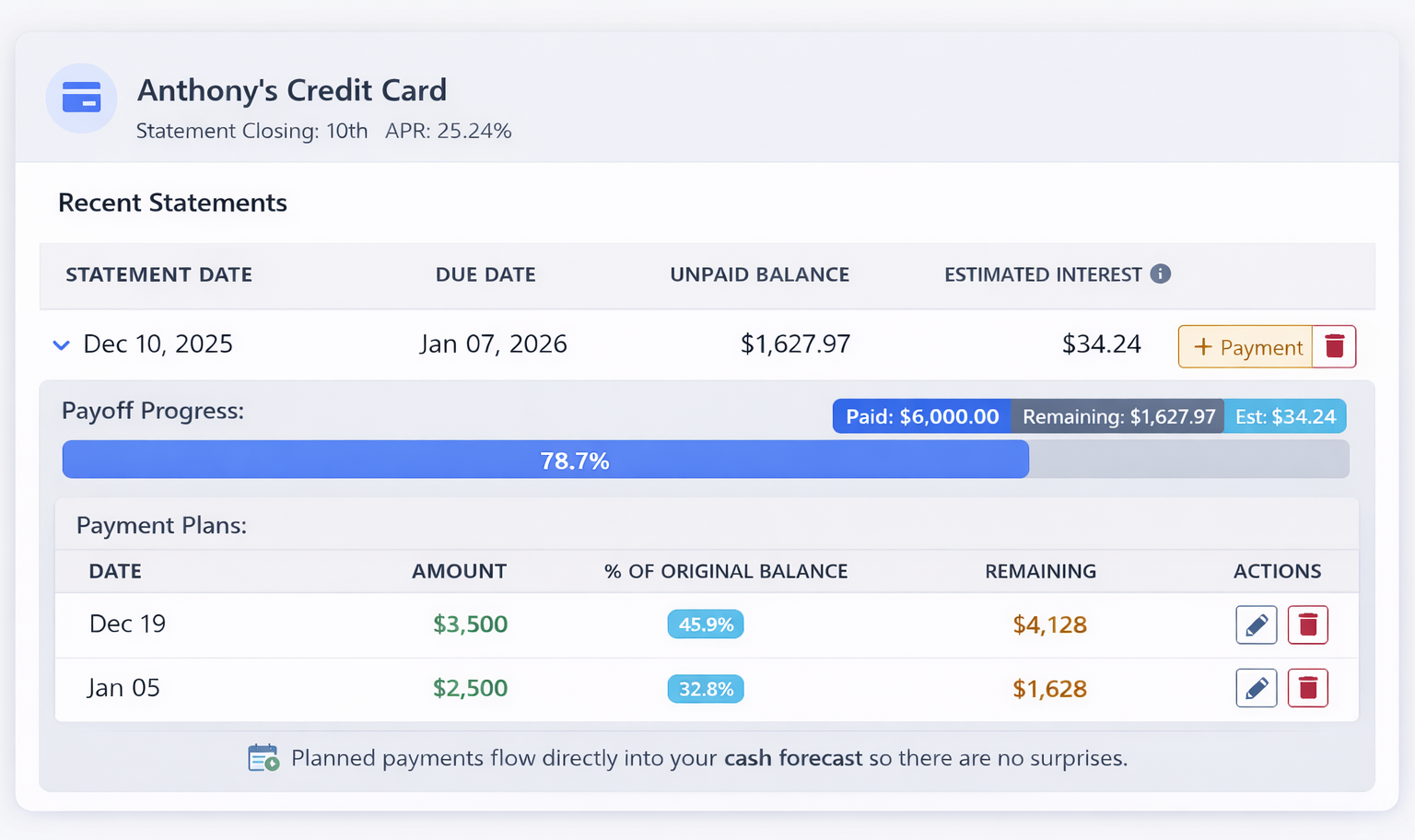

Plan credit card payments to avoid interest

Schedule payments before due dates and see how each payment impacts your cash balance. Never pay unnecessary interest charges again.

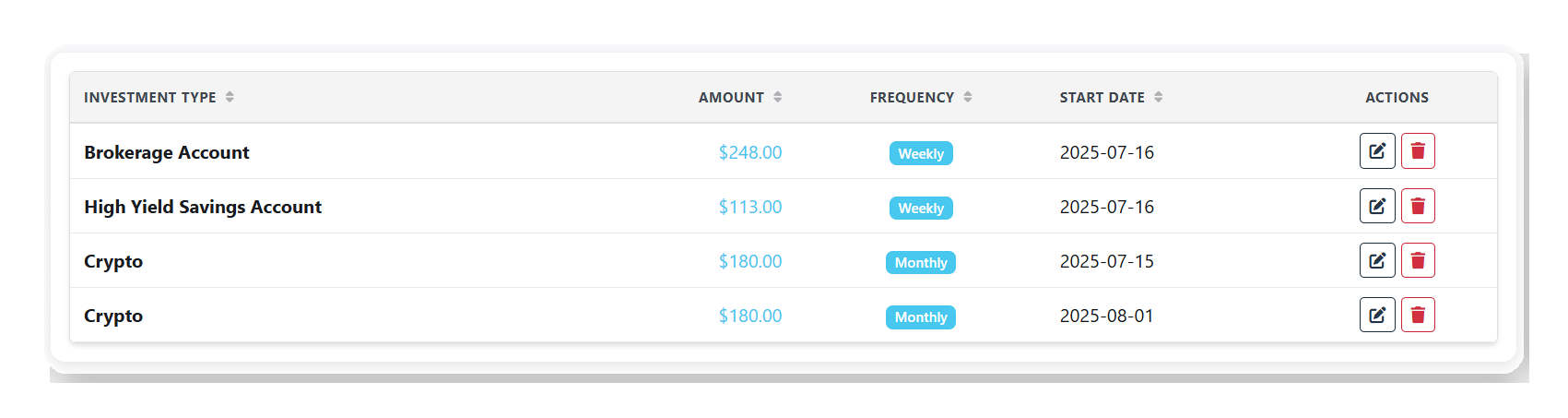

Automate savings and investments toward goals

Give every dollar a job. Set aside money for investing, emergencies, or goals without guessing what you can afford.

Run scenarios for big purchases and travel

Test "what if" plans before committing. See how vacations, major purchases, or other big expenses affect your cash over time.

How it works in 4 simple steps

Enter your current cash balance

Start with what you have in your checking account today.

Pick the date range you want to analyze

Look ahead a week, a month, or even longer.

Add your incomes and outflows

Enter paychecks, bills, subscriptions, and one-time expenses.

Review your projected cash flow and adjust

See your daily balance and make informed decisions.

What users are saying

"This tool was very helpful in showing me precisely how and when my savings would be increasing or decreasing."

— Jamal

"I love the dashboard, the visuals and graph are really good and easy to use. I'll definitely be using this every month for planning."

— Antonio

"I loved seeing the daily balance chart. Being able to see my balance weeks ahead instead of guessing is really valuable."

— Mea

Simple pricing

Cash Compass

Full access to forecasting, payment planning, and scenarios.

Cancel anytime.

- Unlimited cash flow forecasting

- Credit card payment planning

- Investment tracking

- Scenario planning

- Daily balance projections

No commitment required.